Tony Song | The dark forest of cryptocurrency

We cannot leave the future of finance to venture capital funds as people move their lives to the digital land, while scammers prey in and amongst the commercialised hype.

The dark forest of cryptocurrency is certainly mysterious, and the appeal is undeniable. The internet is bursting with success stories of those who became overnight millionaires, so it makes sense that investors are willing to gamble on it… a lot. But it’s not all tech bros and Doge coins – cryptocurrency is the next big step in technology. The tricky part, however, is avoiding the fraudsters and thieves who prey on the first-time investors entering the market. As the vast crypto forest grows rapidly and becomes more dangerous and volatile (in 2021 over $7.7 billion worth of cryptocurrency was stolen from victims worldwide), how can we better equip those investors looking to buy in?

Transcript

Ann Mossop: In a world of global pandemics, climate emergencies, and ever-increasing costs of living, it's understandable that we might feel fearful about what the future holds. But as we make our way through the 21st century, there are, in fact, many new and exciting discoveries which can improve our lives. I'm Ann Mossop, director of the UNSW Centre for Ideas. Welcome to What comes next? From the potential healing powers of magic mushrooms in mental health, to how x-ray vision might help us transition to a renewable economy. In this 10-part series, we'll hear from UNSW Sydney’s brightest minds, unpacking some of the big ideas, which are integral to our 21st century challenges.

More people than ever are investing in cryptocurrency, even though its value seems to become more and more volatile every day. How do we protect the everyday investor from financial ruin? UNSW Sydney Research Fellow Tony Song asks, how can you govern cryptocurrencies when their appeal lies in being ungovernable?

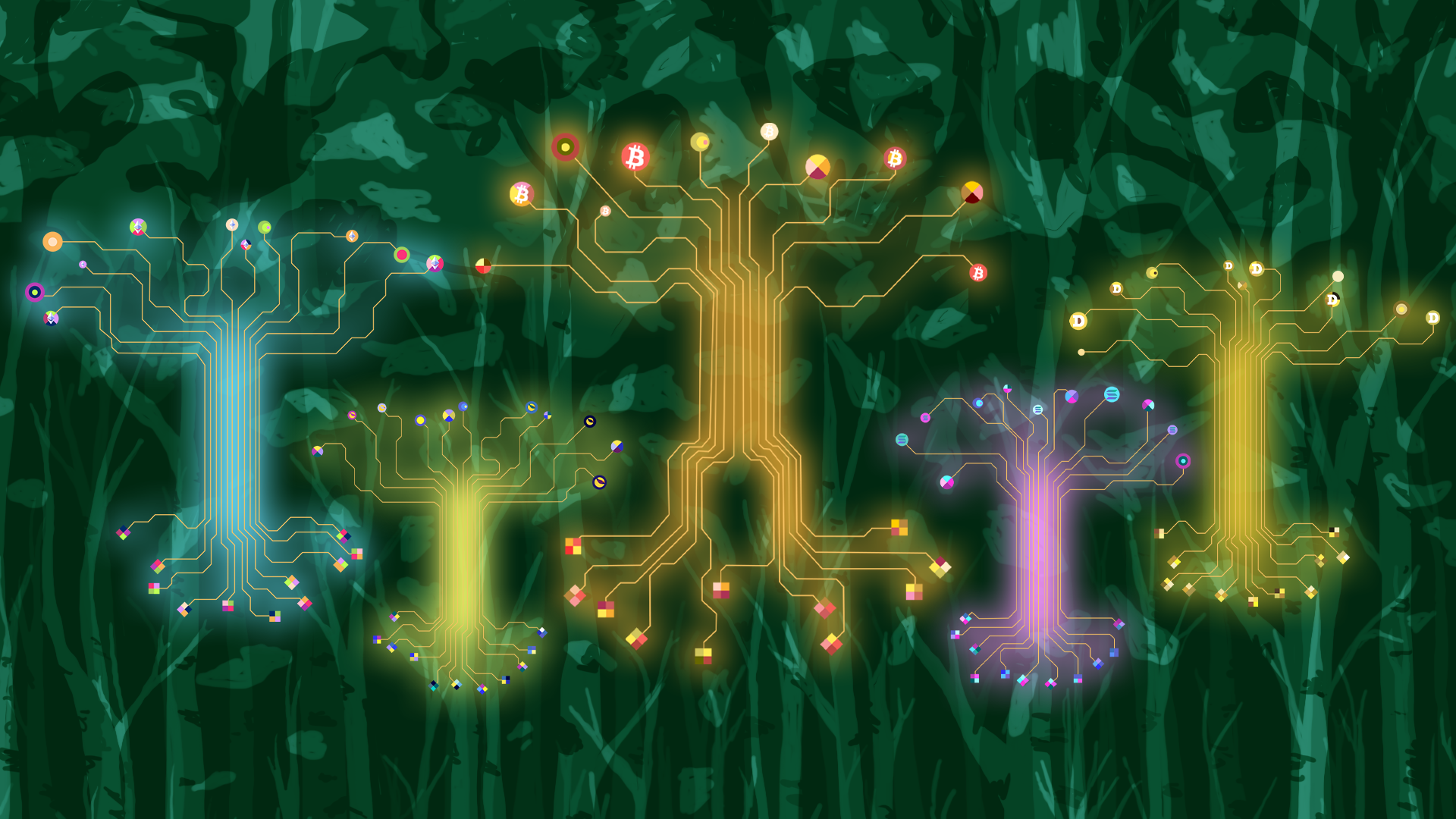

Tony Song: Great. You're here just in time. We've got a lot to build. Yes, build the crypto industry. Wait, wait, what do you mean you don't know what a crypto is? You know, the future of finance? Web 3.0. The Metaverse. Surely you've heard of that? No, not meta-Facebook. I mean, the real metaverse. Okay. Okay. That's all right. Let me show you. Welcome to the forest of crypto, a world where you can turn $1,000 into $10,000, back into $1,000. All in a day's work. A space where you can make a living, and a very comfy living at that, buying, selling or what we in the business call, flipping, monkey JPEG images. Or a place where you can invest in tantalizing financial products like SushiSwap, PancakeSwap, or Maple Finance. Oh, and of course, there's Dogecoin. You know, if you'd bought $1,000 of Dogecoin at the beginning of last year, you'd have made 121,000 US dollars only five months later. Pretty crazy right? Nah, you see, if instead you had bought a coin called Shib short for Shiba Inu. You'd be a multimillionaire, only one year later. And that's the industry. But mind you, it's not all dog coins and food finance here. This place is filled by the likes of cypherpunks OG vanguards of privacy. There's Devs, builders, miners, entrepreneurs, speculators, artists, and perhaps most importantly, refugees. Whether it be those sick of an inherently rigged system, or only the rich get richer, or ones who simply don't have a choice. Those in Venezuela, Argentina, or Zimbabwe, where Bitcoin moving 5% a day is nothing when inflation is hundreds of percent in a week. And that's where we are today. The Bitcoin tree.

Now, you're probably wondering why it's a tree? Well, you see, blocks in a blockchain are actually special data structures called Merkle trees. They're great for cryptographically securing and verifying information. And to do so is simple. You just find the Merkel root, you climb up the tree branches, and you reach the information leaf node at the top. Super efficient, and best part of all, it's all public. That's why that myth that crypto is only used by criminals is just, plainly, wrong. Only 0.34% of crypto transactions are used for illicit purposes. I mean, if you want to be dodgy why use something that is both public and traceable. Go use cash and launder your money with HSBC or Deutsche Bank. Don't know what I'm talking about? Go read the Panama Papers. And that's the difference. Trees unlike banks are living breathing records. They're the Timekeepers of the forest. Everything around them, from the climate, the temperature, the humidity, fires, injuries, even the soil's nutritional content is recorded in its tree rings. And here for the Bitcoin tree we see on his trunk 13 rings signaling 13 years of life. And it's growing, in real time. By the end of my talk, a new block would have been mined, recorded and chained to the other blocks. Get it? Block chain. And once chained, it is forever. We call this immutability. Anyone can read the transparent data that sits on chain, and each ring is rich with its own stories. But perhaps the story that comes up time and time again, is that crypto is a bubble.

Well, yeah, there's speculation but how many times has crypto died? According to the media? Yeah, reliably resurrected itself every four years to make complete new all-time highs and capturing millions more in adopters? No, it's not a bubble. It's more a bubble producing tech paradigm, subject to hype cycles. I mean, would you call the railroad a bubble? Or the internet a bubble? You see, crypto is really just the next step in technology. And that's what our second largest tree, the ethereum tree is all about. Think of it like the internet's own decentralized native computer, allowing anyone to build, stack and combine things like digital Lego. Decentralized finance, to become your own bank. NFT's as digital collectibles, video game items, you can truly own. Decentralized governance structures like Dallas, or just having your own self sovereign identity.

But let's just focus on something simple, you know, like payments. Payments are pretty convenient today, you can just swipe or tap your phone as long as you pay a 1% fee. But what if we want to send money to relatives in say, Venezuela? Okay, we pay an inflated Forex fee. But hang on, they don't have a bank account, let alone one that can process Aussie dollars. Because like the other 1.7 billion people in the world, they are unbanked. Oh, what about sending money to a friend in the Ukraine? Can you trust that they will safely and quickly receive their money? In a warzone? Yeah, nah. Okay. So instead, let's try one of these blockchains. Here's one, the Solana tree. Three steps, one, go to the website. Two, create a wallet. Three, get a private seed phrase, password and public address. Done. Give me your public address, and I can send whatever amount in 10 seconds at a cost of a 1,000th of a cent. Right now, in fact. Not bad, right? Now, what happens when you go and plant that seed you just got? Well, if you water it, nurture it and care for it, it will grow and flourish. If you just leave it, it will simply ebb with the rhythms of the forest. But if you feed it fraudulent products, it will wither and die. Because you own it. It's your responsibility. You see, Web1 was read only, where we just consumed information. Web2 was read, write, where centralized tech companies made content creation possible, but in exchange for giving up our data. But web3 is read, write, own. Where instead of creating on rented land, you build on your own. And that's really what the true innovation for something like the metaverse and crypto is. The crazy VR Worlds, that's almost a distraction. No, Web3 is about an Internet of ownership.

For example, something we use every day right now, social media, right? Our networks, conversations and profiles. They're all fractured as these large tech companies harvest and sell our data. And when a platform does something we don't like, say censorship, we find it hard to leave because our identity is tied to that platform. Now imagine instead, your identity is on a blockchain. You can simply uproot your network and move to another platform. Your network belongs to you. Remember, you planted your own seed, grew your own tree, and now bear your own fruits. You can sell them and get compensated. But it's a choice, rather than a requirement of use. That is how social networks should be. But to get there is the task we face now.

As you might have heard, recently, the forest got too big too fast. Many protocols and NFT's were decentralized in name only. Fraudsters disguised as YouTube influencers came in droves, preying on the vulnerability of newcomers. Thieves and hackers stole 7.7 billion in 2021 alone. And of course, corporate institutions showed up, rolling in on their giant machines, chopping, logging and extracting the value for themselves, influencing so many in the space until they lost sight of their original vision. Drunk on the riches of finally joining the very elite they had sought to topple. Until finally, one tree, the Terra Luna tree fell by its own founder's hubris, greed so monetization overtakes organic growth, leading to what we call the great forest fire of 2022. Luna fell from $80 to zero, in a week, crypto lending platforms went bankrupt, hedge funds and traders liquidated. Trillions of market cap, wiped out. But, you know, the worst bit? It was the little guys, the ones who came into the forest, wide eyed and hopeful that maybe this place was different. The lucky ones came prepared with ways to protect themselves. But others didn't even come with a flashlight for us to stumble around in the darkness left to be guided only by false prophets. And so, we enter crypto winter.

So what happens next? Well, luckily, many of these trees are Pyro fitted, meaning fire regenerates them. Remember, Bitcoin grew as a single seed from the ashes of the global financial crisis, this will only be a scar on its 14th treeing. Likewise, ethereum and other trees are still standing, if a little battered. That being said, the forest still needs guardians. We’re too big now to go unpoliced. While this will add friction, we can trade off some wild untamed growth in exchange for stability. Lots has already been done. The idea that this place is a lawless Wild West is a myth. While the forest may be dark, of course laws apply. They have never not applied. This is still society. We're all still human here. And so the same investor protection rules should apply. Including things like transparency, auditing, solvency. But does that mean we simply give up and become regulated banks? Many of these problems can be solved without losing our original vision. And they are, right now. Put simply, it's not about no regulation, but the right regulation. You see, all speculation begins with a spark, and underneath all the crazy irrationalities is a fret of logic, a hope that maybe, just maybe there is something bigger at play here. A chance for a better, more equal world. Think about how young the space is, the risk to reward is there. Plant your seeds now and you will reap the rewards. Go down the rabbit hole. Good luck. And I'll see you on the other side.

Ann Mossop: Tony, thanks for coming to talk to us.

Tony Song: Thanks for having me on.

Ann Mossop: Tell us about your first encounter with cryptocurrency.

Tony Song: Well, it must have been during the 2017 Bull Run. So that was when Bitcoin first I guess, came into the common consciousness. Everybody started buying it and talking about it. And at that time, I didn't actually invest in it. I was just watching it and it got up to $20,000, and I just thought okay, well, this thing is pretty nuts, right? But back then I was very rational and thought to myself, if I don't know what I'm buying, I'm not gonna buy it. I'm not gonna invest. And thank God for that because it crashed back down to, what $3,000, not soon after.

Ann Mossop: When you were observing it did you understand how it worked? What it was doing? What it was for?

Tony Song: So not really, because back then, for me, it was just like, on my newsfeed. People on Facebook, Twitter, talking about it. And just around me, I didn't understand it. And all I really saw was just this coin that I thought was used on the Darknet to buy, you know, illicit substances, going up crazy amounts.

Ann Mossop: You were intrigued by it?

Tony Song: Yeah, I was intrigued by it, because I had done a course in my law degree called drug law and policy. And within that, we actually looked at how these drugs, you know, the supply for them, can, I guess circulate across society ubiquitously, despite the fact that they're outlawed, right? And we got our first sort of introduction to the dark net, and cryptocurrency being used as the currency within the document.

Ann Mossop: So you started finding out more?

Tony Song: Yeah, yeah. So after everything sort of nuked down into nothing, and everyone was complaining about all the money they lost, I thought, hey, now's a chance to actually see what's going on. Because we're not clouded by hype, we can actually see the technology for what it truly is. So if you talk about it from, I guess, a market structure perspective, which is what I often like to look at, it was basically a mean reversion, where value or perceived value from investors had finally returned to the mean, where previously it was overvalued.

Ann Mossop: When did you come to really get interested in the relationship between crypto and law, which is your field of study?

Tony Song: Yeah, so it was really just after looking at crypto in the bear market, which is when I first looked and actually invested in it, funny thing is buying it in a bear market, the trend is down. So I only ever lost money during that time.

Ann Mossop: Always an educational process.

Tony Song: But, when I started to look into it more, obviously, the second thing other than Bitcoin is ethereum. And ethereum has this great innovation within it called smart contracts. And seeing the word contract was obviously very interesting for me, because, you know, contracts are the basis of commercial and the business world. And because previously, I had only seen contracts as a sort of static document, a piece of paper. Seeing that it could be used in an autonomous way, and perhaps, to make things much more efficient, and more agile.

Ann Mossop: So what are smart contracts in ethereum?

Tony Song: So a smart contract is really just a piece of code that executes an agreement autonomously, without the need for a human being to enforce or complete the terms of agreement themselves.

Ann Mossop: And so ethereum is a cryptocurrency?

Tony Song: Yes.

Ann Mossop: What did the smart contracts do, in relation to that currency?

Tony Song: See, that's the thing. They can do anything, because it's code.

Ann Mossop: Okay.

Tony Song: Code is an expression of artistic creativity, right? You can make the codes, for example, become decentralized finance, where instead of relying on a bank to be an intermediary, you can let the code or a computer become your intermediary, when you're trying to process a transaction between two parties.

Ann Mossop: So, this interest that you've started taking in cryptocurrency, you've finished your law degree, finished studying and you spent a year in fact being a crypto trader.

Tony Song: Yeah. So I finished my law degree in the middle of 2020. And I had a brief stint with an international Chinese law firm that was setting up shop in Australia. Then, towards the end of 2020, the Bull Run started and I just thought to myself, okay, I've been looking at this technology, casually, for, you know, the last two years and it's captured my interest. But now, now, it really seems like people are starting to pay attention. That there is something else happening, sieving underneath all of these activities. There seems to be a recognition that this might actually be something more than just a coin. And so I took a leap of faith. I stopped doing law and decided I would become a full-time trader, just so I could experience what it was like in this new industry, this brave new world. And suffice to say, I don't regret it one bit. That was the most interesting year of my life.

Ann Mossop: Was that stressful?

Tony Song: Yes, it was also the most stressful year of my life. Because, when you're trading these products, I myself, you know, as a recent graduate, I didn't have much savings, or much money to my name. So I had to use leverage. And when you use leverage, it's basically amplifying your existing capital, but you run the risk of being liquidated.

Ann Mossop: Well, you're gonna have to put us out of our suspense here, you know, we're gonna go, we're gonna have a bit more of the story. But we do want to know, where did we end up? You're not liquidated? You did okay, one way or another?

Tony Song: Yeah, yeah. So I'm still standing. And actually, I got out at a pretty good time before the whole market crashed. And that was also because I began a new role at UNSW. So I was casually doing research last year while I was trading, and sometimes, you know, the research would take precedence over the trading. And from March of this year, I began a part-time role in the flip stream, in the future of Law and Innovation in the profession, at the UNSW law faculty.

Ann Mossop: And so you've said goodbye for now to that to the crypto trader hat.

Tony Song: Yeah, to the trading, although, since my current job is part-time, there's still one day of the week where I do check up on the markets and, you know, do a cheeky swing trade here or there, but definitely none of that staying up till midnight trading the US session from 10pm to 6am, and trying to get sleep in the afternoon.

Ann Mossop: So what did you learn from that period of time?

Tony Song: I learned so much. Probably the most important thing was how emotional just one person can be, once money is in the picture. And I also learnt that, yeah, ultimately, money isn't the most important thing in the world, because it honestly just comes and goes. And while it definitely feels good to be financially secure, at the same time, it does become meaningless, right? Doing the same thing over and over again. And just having that constant pressure and stress of trying to protect your wealth and having this craving and desire for more once you get that first hit, right? You just want to keep going. And it's really because that's the nature of trading. It's a dopamine hit. Right?

Ann Mossop: Yeah, I mean, what you described sounds a lot like people talking about, you know, gambling or, or other kinds of things.

Tony Song: And that's the thing, in crypto, a lot of that actually is just straight up gambling. You'll see many of these projects that surfaced in this last Bull Run, especially, if this is the Bull Run of dog coins, and food finances and that sort of thing, right? In my presentation, I make allusions to Dogecoin and Shib and various food related financial products. But this was really just a crazy time where innovation and real products were being made, especially in the fields of decentralized finance. And we had, obviously, the NFT boom. But also, because there was just so much happening, it was hard to tell what was real and what wasn't.

Ann Mossop: I think that's a really interesting point, because certainly those of us who are looking at this world from the outside, that would really be one of the issues. If we think about the future. What do you think is the most important thing that an ordinary person needs to understand about crypto at this point in time?

Tony Song: In my opinion, crypto is really just this next step in technology. It's really just a way to re-look and re-engineer the financial system using new innovative technologies and a system that shifts power and redistributes it amongst people around the world, instead of just one centralized authority. I think once you apply these concepts, once you have the ability to tokenize anything and put it on a blockchain that is uncensorable, immutable and decentralized, it just opens the floodgates for any sort of innovation.

Ann Mossop: So cryptocurrency and the world that it represents are obviously a really interesting technology and also a reaction to the way that some of the internet technologies and platforms have evolved. But what we've seen in the last little while is a lot of people losing a lot of money in this space.

Tony Song: Yeah, for sure.

Ann Mossop: And essentially, you know, some of the terrible things that can happen when people who don't really understand this kind of technology can participate on it. The way you've talked about, is quite idealistic in some ways that we see this idea of a democratized uncensorable technology. But are there other things that we need to do to make sure that people are not vulnerable to fraud and to deception in this space?

Tony Song: Yeah, and I would say that is probably the most important thing that everyone in the crypto community needs to start working towards, and understanding that, you know, times have changed, we've reached a scale that this previous sort of Wild West of skirting around regulations and just doing our own thing, that can't really continue because of the adoption and how many eyes and how many people have started buying into this, right? So previously, that allowed for a lot of great innovation to take place. But again, it also allowed for scams and Ponzi’s to emerge, because there wasn't much regulatory oversight over it. Now, we've reached the point of critical mass, and many people don't actually understand the technology before they invest. They see things on the news about these people buying dog coins, you know, buying 500 bucks in Shiba Inu. And next thing, you know, they're basically millionaires, right? They see these things, and they think, okay, well, if this person has done it, why can't I? I just need to find the next Shiba Inu. But the truth of the matter is, that story you're seeing online, that is like winning the lottery. That's not what happens to everybody in this space. Because like all markets, all stock markets are really just one giant game, if anyone plays video games, is a giant MMO RPG, played by everyone in the world, massively multiplayer online role playing game. The ones who are early to buying a narrative or a coin, they do really well, they make a lot of money. But in order to make money from buying or trading or investing, right? You need someone else to buy it from you at a higher price. The people who really move the market, they have bought at a much, much, much, much lower price than you have as a retail investor. And what you need to understand is that because they've bought so low, they have to sell slowly into the demand and create a narrative. They create a narrative through news articles for hype for social media, through Twitter, you know? And so the question then becomes, how do you protect and stop these things from happening? Well, unfortunately, that is just how markets work. If you want to play in this game, and make money, that is just what happens.

Ann Mossop: And so the difficult challenge that the future holds, I would imagine, we have learned with greater or lesser success, how to regulate traditional financial markets and other kinds of ways of doing business. So the challenge is going to be how to develop in parallel with this technological innovation, a means of regulation that takes into account its technological uniqueness.

Tony Song: Exactly. So it's trying to figure out a way to balance innovation with consumer protection, right? Because if you think of it on a sliding scale, if you have too much regulation, then it creates a chokehold on innovation. Now, instead of a bright young person, coming up with an idea and creating their vision into reality, they now have a huge number of barriers and steps before they can even begin that process. They need accountants to do all that indexing and solvency of auditing, any lawyers to tell them what regulations are required before they can even do anything. They need banks and people within financial industries to have custody of all the funds they'll eventually hold on these needs to be regulated banks, right? And then once you do that, all the intermediaries start to fill back into the space. And that's where all the inefficiencies arise, and all the costs increase, and then we sort of go back to where we were before.

But on the other hand, if you just have it be completely unregulated, like it was maybe 10 years ago, then you have stuff like the darknet markets, right? Where it's an actual lawless, Wild West where anything goes. And you definitely don't want that. You need to find a sweet spot, a middle ground, right? And I think what's most important, though, is that, because crypto is such a, you know, hyper intellectualized industry, there are a lot of smart people moving into the space, and they're trying to solve this problem of this balance. And I think crypto does have the advantage because it has this sort of backing, and you will be able to solve a lot of these problems through self regulation. But the problem will be whether we can achieve that in the space of time that we have right now.

In the industry, they talk about a window of opportunity, maybe this last five years, where regulators, governments and banks, they sort of gave crypto like a free pass to test the waters and see where it could go. Unfortunately, it looks like that window has now passed with the recent collapse of Terra Luna and Celsius and all these other retail facing platforms. But if you look at the actual collapse a bit more specifically, you'll see that what collapsed wasn't so much the decentralized protocols or the code itself, the code for the collapse of Luna actually worked exactly as intended. What collapsed was the centralized entities that controlled most of what collapsed, of these companies, right?

For example, in Luna, you had the CEO, Do Kwan, who after being successful, initially, he continued to sustain the protocol at a level that was just not possible, he had this platform that allowed you to obtain 20% interest on your US dollars. Which is, if you look at the rates compared to any normal bank, that's insane. And the difference was that you didn't have to hold a crypto, which was a volatile asset, you could hold a stable coin. So it was UST, tera-USD. And by holding that, people, they felt safe. This is just the US dollar. And so they put their entire life savings in because of that. And it seemed like it was too big to fail, because you had all these huge investors, you know, the leaders in the crypto space, also investing alongside it. When I saw Luna start to collapse, it was actually unbelievable for me. Seeing this protocol that you know, was like a darling child. It's like those who trade in the stock market, something like if Afterpay just started, like, collapsing and dying.

Ann Mossop: You'd be very surprised.

Tony Song: You’d be very surprised, right? Yeah.

Ann Mossop: Well, it's certainly a challenge. And I think you know, as a researcher and a thinker about these issues, you've got a big piece of work ahead, to work out how to navigate this delicate balance.

Tony Song: Yeah, exactly. If I could end on one point, I think there’ll be, what will arise, is there's going to be two streams of the way protocols within the cryptocurrency space are going to move now. On one hand, you will have the key players, the ones who want to play by the rules and want to be regulated. They want guardrails and ways to ensure that their business is seen as legitimate, right? They want to operate on the same level as their peers in the traditional finance world, but use a technology that is just you know, a 21st century technology rather than whatever the banking system the SWIFT system is using, right? But then on the other hand, you'll have those who want to push for this full, decentralized, idealistic model I did touch on a bit earlier. They're, like, the cypherpunks, right? The early movement of crypto, and they're going to resist regulation at every turn. And how they're going to do that is by decentralizing themselves further, when regulation comes for them, they're going to split and become even more difficult to control. And what we need is actually for both to coexist, so that consumers can make a choice. If they do the correct research, and they believe in a new ethos for a new system that has the potential to be more equal and more fair than what we have currently. Then they can go on the more decentralized path. But for the average Joe, you know, the average retail investor, they need to be able to have assurance that whatever they enter, whatever they invest in, whatever they buy will actually be a safe store value, a regulated asset. And that's where we need to build out and ensure that while the ethos of crypto can still remain, at the same time, there needs to be an option for consumers.

Ann Mossop: Thank you so much, Tony. And we look forward to seeing how this all unfolds.

Tony Song: Thanks so much for having me on it.

Ann Mossop: What comes next? is produced by the UNSW Center for Ideas. With music composition by Lana Zacharia and editing by Bryce Halladay. For more information, visit centreideas.com, and don't forget to subscribe wherever you get your podcasts.

Image Gallery

-

1/3

-

2/3

-

3/3

Tony Song

Tony Song is a research fellow for the NSW Law Society’s Future of Law and Innovation (FLIP) research stream in the School of Private and Commercial Law, Faculty of Law and Justice, UNSW Sydney. Song’s research explores the impact of technology on the legal profession and society, with a particular focus on artificial intelligence, online courts, drones, and managing trust in an online world. Tony is most passionate about all things web3, whether it be trading the volatility of the markets, delving into the latent world of smart legal contracts, cheering on the surreal hilarity of the metaverse, or just tending to his humble defi yields – there's never a boring day in crypto.